- Home

- Our Solutions

-

-

Receive payments in India

- Service Providers/ Freelancer

- MSMEs

- Payment Links

- XPI

- Amazon

-

Collect payments from India

- INR Collections

-

-

- Company

- Resources

- Get Started

- Let's Talk

- Login

INR Collections

Made Easy for

Global Enterprises

One integration lets global platforms accept INR, lock FX, and settle next day while all compliance is handled in the background.

For PSPs • Marketplaces • SaaS & Media

Enhance collections by enabling

local payment options

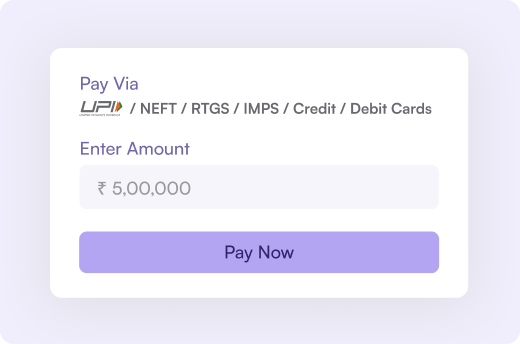

Provide your customers with fast, low-cost, and reliable bank transfers and UPI payments directly through your product

Collect in INR

Via UPI, Cards Net Banking and A2A payments

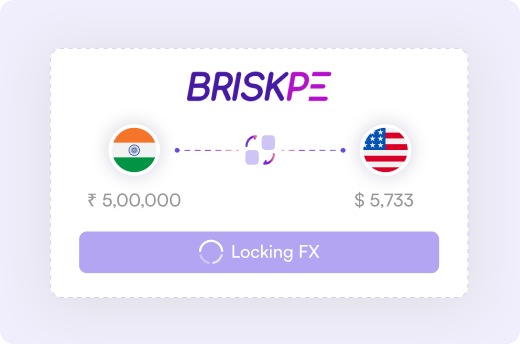

FX Lock

Get fixed FX rates

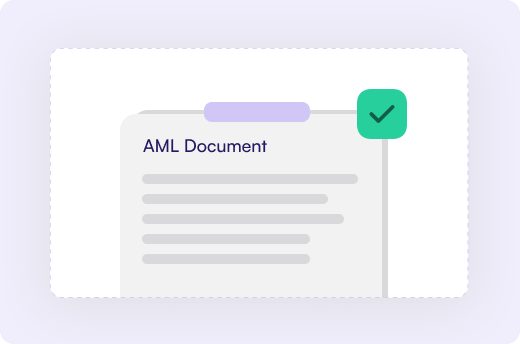

Compliance

Transaction monitoring AML checks are done

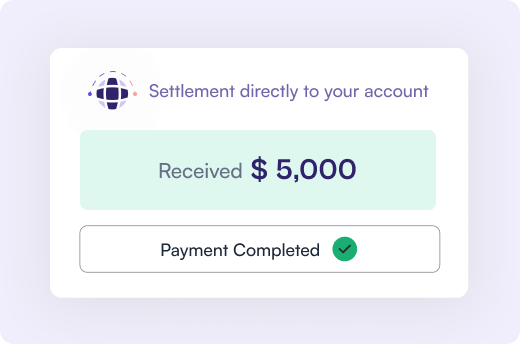

24 hrs Payout

USD/EUR/GBP lands next day

Grow your global payments business

with BRISKPE’s APIs

Our APIs are robust, intuitive, and built for seamless cross-border transactions which integrate fast and gain an edge in a rapidly growing market.

White-Label & API Ready

BRISKPE's APIs streamline global money transfers and give you limitless possibilities to craft a payment experience that fits perfectly into your product.

Marketplace-Ready Cross-Border Payment Infrastructure

Receive funds from India instantly through compliant, RBI-approved channels. Simplify collections, automate settlements, and stay audit-ready with end-to-end transparency.

Recurring Payment Subscription from india

Enable automated, compliant subscription billing powered by Indian payment rails. Collect recurring payments in INR, securely, instantly, and effortlessly.

Secure, compliant infrastructure

you can build on with confidence

RBI-compliant flows encrypt transactions, stream real-time updates, and offer detailed OpenAPI docs for full transparency.

API Gateway

FX & Ledger Engine

Compliance Micro-service

Security Layer

Faster Settlement (T+1)

Funds arrive next business day, 3-5x faster than SWIFT.

Compliance Managed

Digital KYC, AML, e-FIRA handled automatically.

Unified Checkout

UPI, cards, net-banking, wallets via one SDK.

Instant Payment Links

Share a branded link; get paid in minutes.

White-Label & API Ready

Embed under your brand or use our UI.

Real-Time Notifications

Instant webhooks for every transaction status.

Licensed & Compliant Infrastructure

Secure, regulation-ready platform with global standards built in.

PACB licensed and RBI compliant for regulated operations

SWIFT-enabled for secure and traceable cross-border transfers

KYC to e-FIRC, securely stored and audit-ready

Frequently Asked Questions

Absolutely. Your BRISKPE virtual account collects payments in foreign currencies, and we convert and transfer them to your Indian bank account at competitive rates.

Yes. BRISKPE supports Amazon sellers, freelancers, and global service providers. Accept payments in major currencies like USD, GBP, EUR, AUD, CAD, and SGD — securely and at competitive FX rates.

No. Sign-up is absolutely free. Enjoy global account access, real-time FX rates, and low-cost, transparent international transfers.

We Are Here To Help

Chat To Support

Get help with your account and services.

Sales Inquiries

Interested in our services? Talk to our sales team.

Call Us

Mon-Sat from 8am to 8pm.